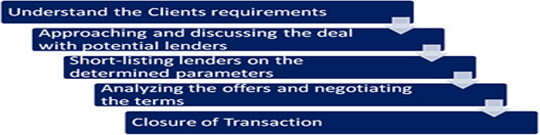

Debt Syndication is the distribution of the money advanced in situations when large loans needs to be distributed among a number of companies or investors. It is the adoption in which several banks and financial institutions share the making of a large loan. Financial outlook thus seals the deal for you which in turn provides you the right mix of investors that work perfectly for you.

D L Corporate Group provides suggestive methods in setting up the entire financial support necessary for a particular project. It is one of the most important factors, that comes along with our project consultancy.

Categories

- Working Capital Management

- Debt Swapping

- Debt Enhancement

- Reduction In Cost of Fund

Debt Syndication is a part of our project consultancy. D L Corporate Group working with PSU Bank and Channel Partners of many Private Sector Banks & NBFC namely Religare Finvest Limited, Tata Capital Limited, Reliance Capital Limited, Future capital Limited, L & T Finance Limited, Indiabulls Housing Finance Limited, Cholamondalam , Sriram Housing Finance Ltd, HDB (Sister concern of HDFC Bank), Standard Chartered Bank, Axis Bank, Indusind Bank, Kotak Mahindra Bank, Aditya Birla, Punjab National Bank and Adhar Housing Finance.

Working capital is a financial metric which represents operating liquidity available to a business, organization or other entity, including governmental entity. Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital. Gross working capital equals to current assets. If current assets are less than current liabilities, an entity has a working capital deficiency. A company can be endowed with assets and profitability but short of liquidity if its assets cannot readily be converted into cash. Positive working capital is required to ensure that a firm is able to continue its operations and that it has sufficient funds to satisfy both maturing short-term debt and upcoming operational expenses. The D L Corporate Group manages the working capital which involves managing inventories, accounts receivable and payable, and cash for good business enhancement.

Our work regarding Working capital involves -- • Cash Credit • Over Draft • Bank Guarantee • Letter Of Guarantee • Letter Of Credit • Packing Credit • Buyers Credit • FBP • Factoring • Working Capital Term Loan (New Projects, Business Expansions)

A debt swap is a refinancing deal in which a debtholder gets an equity position in exchange for cancellation of the debt. The swap is generally done to help a struggling company continue to operate (after all, an insolvent company can't pay its debts or improve its equity standing). D L Corporate Group has efficient personnels to help our clients to overcome such situations by helping/ dealing with all the neccessary finnacial supports.

It is a transaction in which the obligations (debts) of a company or individual are exchanged for something of value (equity). In the case of a publicly-traded company, this would generally entail an exchange of bonds for stock. The value of the stocks and bonds being exchanged are typically determined by the market at the time of the swap.

Debt Enhancement is a method whereby a company attempts to improve its debt or credit worthiness. Through debt enhancement, the lender is provided with reassurance that the borrower will honor the obligation through additional collateral, insurance, or a third party guarantee. Debt enhancement reduces credit/default risk of a debt, thereby increasing the overall credit rating and lowering interest rates.

Debt Enhancement is used to obtain better terms for an outstanding debt. Securitization, posting collateral and obtaining external debt enhancement such as a letter of credit are some basic forms of debt enhancement. Firms may also increase cash reserves to uphold superior solvency ratios. We at D L Corporate helps our clients will such facilities.

Cost of funds is the interest rate paid by financial institutions for the funds that they deploy in their business. The cost of funds is one of the most important input costs for a financial institution, since a lower cost will generate better returns when the funds are deployed in the form of short-term and long-term loans to borrowers. The spread between the cost of funds and the interest rate charged to borrowers represents one of the main sources of profit for most financial institutions.

DLCG manages to reduce such cost of fund since a lower cost will generate better returns when the funds are deployed in the form of short-term and long-term loans to borrowers.